Our Mission

At AutoByPayment.com, we set ourselves apart from other car buying websites by focusing exclusively on the financial aspects of purchasing a vehicle. In today's automotive landscape, where over 80% of cars are financed, and a significant 75% of Americans face credit challenges, our mission is crystal clear: we're here to empower car buyers. Our goal is to help you determine your affordable budget, identify lenders who will approve your financing, and establish a fair dealer price for your dream vehicle.

You might notice that the payment information you find on our website could be slightly higher compared to other platforms, and that's for a good reason. Our commitment is to provide you with the most precise and reliable payment estimates on the web. To achieve this, we take into account a comprehensive set of factors, including the destination charge when displaying the Manufacturer's Suggested Retail Price (MSRP), sales tax in accordance with your state's tax regulations, typical DMV fees for your state, any new car rebates available, potential negative trade-in equity, average state Dealer Document Fees, as well as the average interest rates and loan terms tailored to your unique credit score.

Car Loan Payments

What makes up a payment?

- Vehicle Price including Destination Charge

- State Sales Tax

- License Fees

- Dealer Fees

- Down Payment & Rebates

- Trade Equity or Negative Equity

- Interest Rate & Loan Term

Negative Equity

Your credit rating doesn't define your car-buying possibilities. However, if you're facing negative equity with your trade-in, securing approval from a lender for a new car purchase might present some hurdles. Fortunately, new car rebates come to the rescue, bridging the gap between the value of your trade-in and the amount owed to the finance company.

Privacy

While it's true that some websites enable car buyers to explore vehicles based on accurate payment estimates, these platforms often demand the surrender of personal information and the completion of a pre-approval process. Unfortunately, this can result in car buyers receiving unsolicited offers from local dealerships before they are fully prepared to make a purchase.

With AutoByPayment.com, we prioritize your privacy and convenience. Here, you have the freedom to self-select your credit rating and obtain precise payment estimates without the need to disclose personal information. When you're ready to make your purchase, you can confidently complete the approval process either at the dealership or through a lender of your choice, without any unwanted solicitations.

The 3 Satisfying Steps

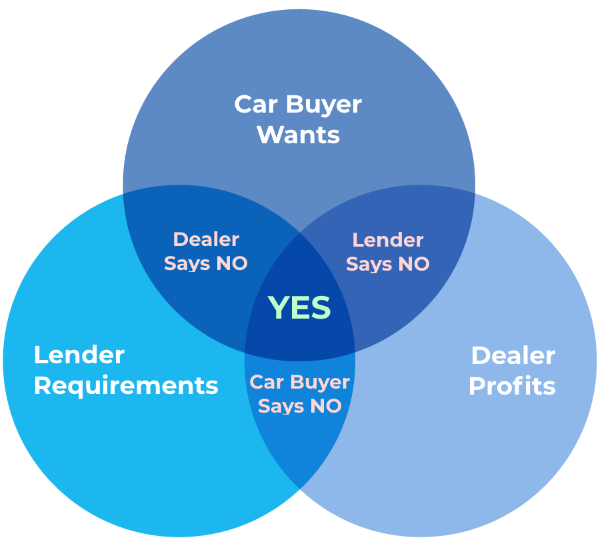

Whenever a vehicle is financed, there must be a meeting of minds among three key parties: the car buyer, the vehicle seller, and the lender. It's this harmonious agreement that paves the way for a successful car deal. At AutoByPayment.com, we refer to this process as the "Three Satisfying Steps," and our site is designed to help you find vehicles that align with these crucial criteria.

What Satisfies the Car Buyer?

- A vehicle that suits their lifestyle.

- A fair price for the vehicle.

- Affordable monthly payments.

- Agreeable financing terms.

What Satisfies The Dealer?

- The opportunity to make a profit.

- The ability to sell an older inventory unit.

- The chance to gain a customer for their service department.

What Satisfies the Lender?

- Loans that adhere to their specific guidelines.

- Monthly payments that are less than 12.5% of the customer's income.

- Loan-to-Value limits determined by the customer's credit tier.

Credit Rating

New vehicle lending programs cater to individuals across all credit tiers. However, it's important to note that only approximately 20% of all car purchases are financed by individuals with poor (scores ranging from 500 to 600) or bad credit (scores from 300 to 500). This is primarily due to lender policies regarding Loan-to-Value ratios and maximum payment limits. Generally, the lower your credit score, the more restrictive these factors become. Regardless of your credit score, our website can provide you with estimates for both your monthly payment and required down payment, based on your credit score, to help you acquire the vehicle you desire.